TAX INFORMATION IMPORTANT HEALTH COVERAGE TAX DOCUMENTS Responsible individuals may receive a copy of their Form 1095-B (Health Coverage) by calling our Fund Office at 800.251.4107or 855.450.1875, by emailing a request to hra@uswbenefitfunds.com, or by ma

TAX INFORMATION

IMPORTANT HEALTH COVERAGE TAX DOCUMENTS

Responsible individuals may receive a copy of their Form 1095-B (Health Coverage) by calling our Fund Office at 800.251.4107or 855.450.1875, by emailing a request to hra@uswbenefitfunds.com, or by mailing a request to USW HRA Fund, 1101 Kermit Drive, Suite 800 Nashville, TN 37217. Once your request is received, a copy of your Form 1095-B will be furnished within 30 days.

Pension Fund FAQs

-

I have decided to retire. When do I request a Pension Application form?

You should obtain an application form approximately 90 to 120 days in advance of the date you elect to retire.

-

How do I apply for pension?

To apply for benefits, please call 1-800-474-8673 to request an application.

Please note, in order to begin your pension, you must not be working for an employer contributing to the Pension Fund or at an employer with a USW contract. If you are under 65, you must not be working for any employer in the same industry as the employer at which you worked while in covered employment, an employer contributing to the Pension Fund, or an employer with a USW Contract.

-

What documents are required to be submitted to the Fund Office?

A copy of your birth certificate, and if you are married a copy of your spouse’s birth certificate as well as a copy of your marriage license or marriage certificate. If you have been divorced, we will need a copy of your divorce decree that has been filed with the courts and signed by the judge.

Military credit is granted if you began working for a contributing employer, left to go into the military service, and then upon release from the military you returned to working for the contributing employer. In this case, you would need to provide the Fund Office with a copy of the DD214 form. If you were in the military prior to working for a contributing employer, no credit would be granted and it is not necessary to provide proof of military service.

-

When do I receive my payment?

Payments are sent on the first business day of each month. You should contact your bank to verify that your payment has credited to your account. Note: all payments will be sent by direct deposit by April 2013. For participants still receiving checks, you will need to enroll in direct deposit by calling 1-800-251-4107 or by using our direct deposit form.

-

How do I get a letter verifying my income?

You may call 1-800-474-8673 or write the Fund Office and request to receive a letter verifying the effective date and amount of your pension benefit.

-

What happens if my company is closing? How do I find out what my benefit may be?

Contact your USW Representative and have them call the Fund Office at 1-800-474-8673 and ask to speak with Connie Cornelius. She is available to go to your employer or Local Union Hall to do presentations on your benefits and to answer questions about applying for your pension.

-

How do I change my address?

To change your address, complete the change of address form or call the Fund Office at 1-800-251-4108.

If you are signing up for direct deposit, you can indicate your new address on the direct deposit form.

You must update the Fund Office of any address changes to prevent interruption in benefits.

-

How do I sign up for direct deposit?

- We no longer accept direct deposit information over the phone.

- In order to submit/update your direct deposit information you must complete and submit a form. Note: You do not need a separate form to change your address.

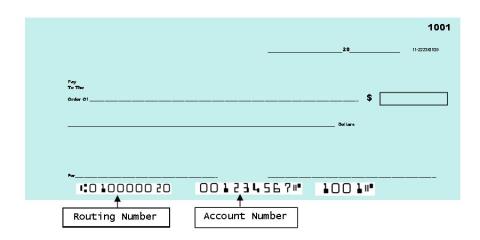

Before you fill out the form, be sure you know your bank’s routing number and your account number. If you have a checking account, this information can be found on the bottom of a check (see image).

**If you are using a reloadable debit card, the account number and routing number should be provided from the company who issues the cards. (The account number is not the number on the face of the card).

If you are unsure of the routing number and/or account number, call your bank to confirm.

Important Dates

Updated Direct Deposit Forms must be received on or before the 15th of the month prior to your next payment to be processed on time.

-

How do I find QDRO Procedures?

Please see our QDRO instructions in the documents section.

-

How do I get a copy of the Summary Plan Description?

Welcome to the Fund Office!

USW Benefit Funds comprises three Taft-Hartley Trusts:

- The PACE Industry Union-Management Pension Fund (PIUMPF)

- The USW Industry 401(k) Fund

- The USW HRA Fund

Each Fund is governed by a Board of Trustees with both labor and management. All must be negotiated and must be included in the collective bargaining agreement.